Introduction

In today's rapidly evolving financial landscape, fintech is revolutionizing the way businesses and individuals manage their finances. The European market, known for its innovation and regulatory advancements, is at the forefront of this transformation. In this article, we delve into the latest developments in the European fintech sector, providing insights into key trends, notable market players, and the impact of emerging technologies.

Emerging Trends in European Fintech

One of the most significant trends in the European fintech market is the rise of digital banking. As more consumers embrace digital solutions for their financial needs, traditional banks are under pressure to adapt. Fintech startups, such as Revolut and N26, have gained considerable traction by offering users seamless digital banking experiences. These platforms have been able to capture a significant market share due to their user-friendly interfaces, competitive pricing, and innovative features.

Regulatory Advancements and Compliance

The European Union has been proactive in developing a regulatory framework to support the growth of the fintech industry. The Payment Services Directive (PSD2) and the revised Payment Services Directive (PSD2) have paved the way for greater innovation and competition in the European payments market. These regulations have allowed third-party providers (TPPs) to access and utilize bank data, fostering innovation and providing consumers with more choices.

Notable Market Players and Investments

Several notable fintech companies have emerged in Europe, attracting significant investment. One of the most prominent examples is Stripe, a payments company valued at $95 billion. Stripe's expansion into Europe has been a significant factor in the growth of the region's fintech industry. Other key players include Adyen, a payments platform, and Revolut, a digital banking app.

Impact of Emerging Technologies

Emerging technologies are playing a crucial role in shaping the future of European fintech. Blockchain technology, for example, has the potential to revolutionize various financial services, including payments, remittances, and identity verification. Additionally, artificial intelligence (AI) and machine learning are being leveraged to enhance customer experiences, improve fraud detection, and automate processes.

Case Studies: Successful European Fintech Companies

Revolut: This London-based digital banking app has gained a significant following by offering users free currency exchange, borderless accounts, and a suite of other financial services. Revolut has raised over

1.7 billion in funding and is now valued at 5.5 billion.Adyen: Adyen, a Dutch payments platform, has seen rapid growth by offering a wide range of payment methods, including credit cards, bank transfers, and mobile wallet solutions. The company has processed over

50 billion in transactions and is valued at 29 billion.N26: This German fintech startup has gained popularity for its user-friendly mobile banking app and no-fee banking services. N26 has raised $400 million in funding and is now available in several European countries.

Conclusion

The European fintech market is experiencing remarkable growth, driven by innovative companies, supportive regulations, and emerging technologies. As the industry continues to evolve, it will be interesting to see how these players shape the future of financial services in the region. Stay tuned to FintechZoom.com for the latest insights and developments in the European fintech sector.

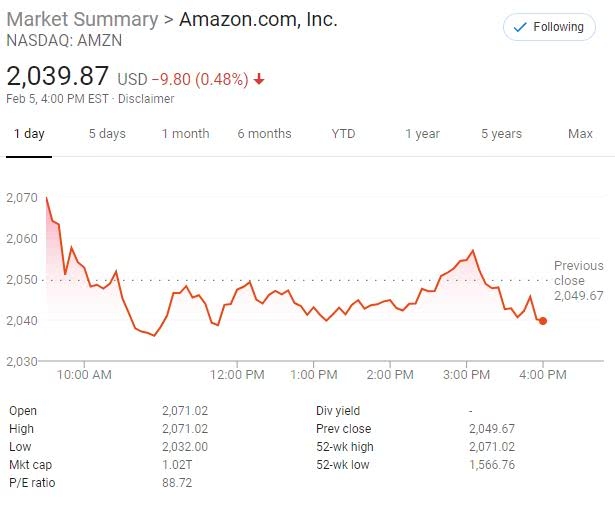

us stock market today live cha

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....