In the world of investing, understanding the value of shares is crucial. Whether you're a seasoned investor or just starting out, knowing how to determine the price of a share can make a significant difference in your investment decisions. In this article, we'll delve into what affects share prices, how to find them, and some key factors to consider when evaluating the value of a stock.

What Determines Share Prices?

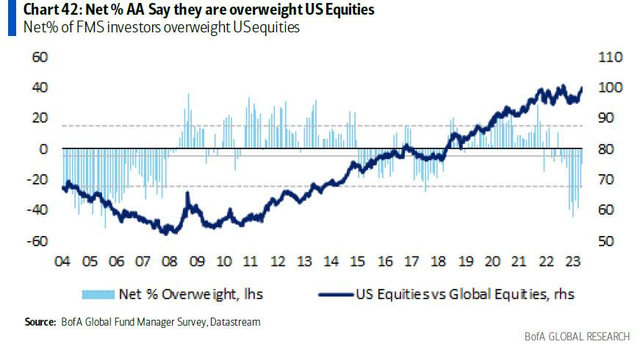

Market Supply and Demand

The most fundamental factor influencing share prices is the basic economic principle of supply and demand. If more people want to buy a particular stock than there are shares available, the price will increase. Conversely, if there are more shares available than buyers, the price will decrease.

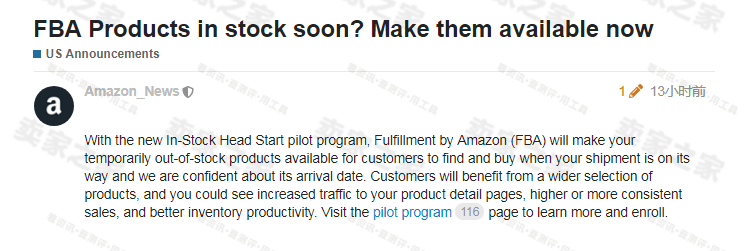

Company Performance

The financial health and performance of a company play a crucial role in determining its share price. Positive earnings reports, strong revenue growth, and innovative products or services can drive up share prices, while negative news, such as poor earnings or product recalls, can cause prices to fall.

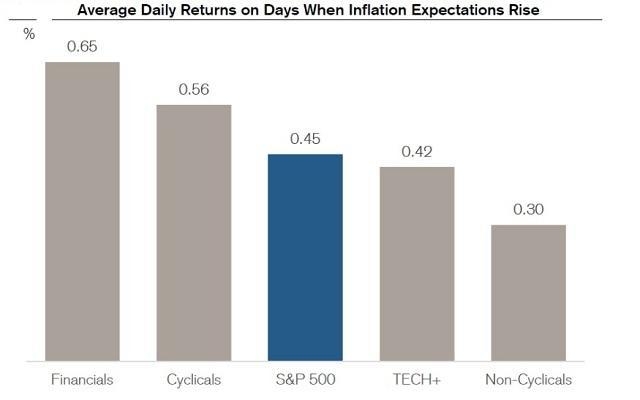

Market Sentiment

The overall sentiment of the market can also impact share prices. When investors are optimistic about the economy and the stock market, they are more likely to buy stocks, pushing prices up. Conversely, when investors are pessimistic, they may sell their shares, leading to a decline in prices.

Dividends

Companies that pay dividends can see their share prices increase as investors seek out income-generating investments. The amount of the dividend and the company's ability to sustain or increase it over time can influence share prices.

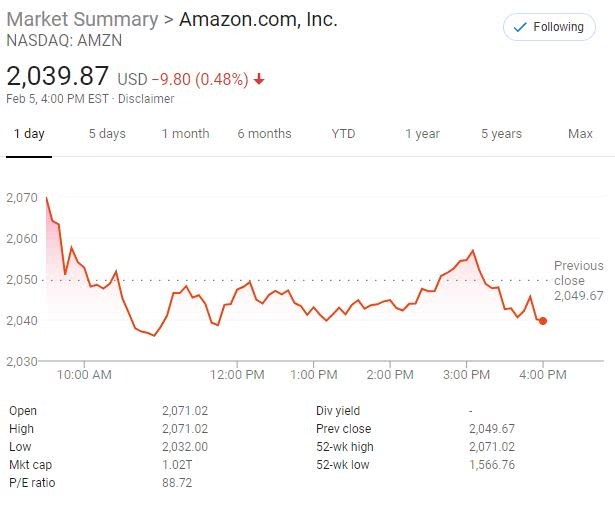

Finding Share Prices

To find the current price of a share, you can check financial news websites, stock market apps, or your brokerage account. Websites like Yahoo Finance, Google Finance, and CNBC offer real-time stock prices and historical data.

How to Evaluate Share Prices

When evaluating the value of a share, consider the following:

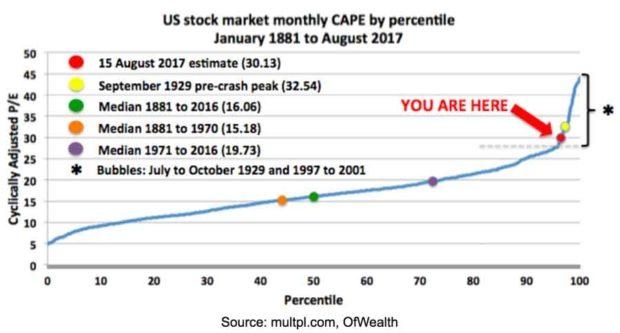

- P/E Ratio (Price-to-Earnings Ratio): This ratio compares the price of a share to the company's earnings per share. A high P/E ratio may indicate that a stock is overvalued, while a low P/E ratio may suggest it's undervalued.

- Dividend Yield: This measures the income generated by a dividend relative to the stock's price. A higher dividend yield can make a stock more attractive to income investors.

- Market Capitalization: This is the total value of a company's outstanding shares. Large-cap companies tend to have more stable share prices, while small-cap companies may be more volatile.

Case Study: Apple Inc. (AAPL)

Let's take a look at Apple Inc. (AAPL) as an example. As of the time of writing, Apple's share price is around $150 per share. This price is influenced by various factors, including the company's strong financial performance, high market capitalization, and substantial dividend payments.

Conclusion

Understanding how much shares are worth is a vital part of investing. By considering factors such as market supply and demand, company performance, market sentiment, dividends, and other valuation metrics, you can make more informed investment decisions. Keep in mind that the stock market is dynamic, and share prices can change rapidly. Stay informed and stay vigilant to make the best investment choices for your portfolio.

us flag stock

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....