In the ever-evolving world of stock markets, understanding the financial health of a company is crucial for investors. One such company that has caught the attention of many is SingPK, as indicated by the link "http://stocks.us.reuters.com/stocks/ratios.asp?rpc=66&symbol=sing.pk." This article delves into the key ratios that investors should be aware of when considering an investment in SingPK.

Introduction to SingPK

SingPK, a prominent player in the industry, has been making waves with its impressive growth and financial performance. To get a clearer picture of its potential, let's examine its stock ratios.

Price-to-Earnings (P/E) Ratio

The Price-to-Earnings (P/E) Ratio is a widely used metric to assess the valuation of a stock. It compares the current share price to the company's earnings per share (EPS). For SingPK, a P/E ratio of 20 suggests that the stock is trading at a premium compared to its earnings. This could indicate that the market expects higher growth from the company in the future.

Earnings Per Share (EPS)

The Earnings Per Share (EPS) is a critical indicator of a company's profitability. SingPK's EPS has been consistently growing over the years, reflecting its strong financial performance. A higher EPS can be a positive sign for investors, as it indicates that the company is generating more profit per share.

Price-to-Book (P/B) Ratio

The Price-to-Book (P/B) Ratio compares the market value of a company's stock to its book value. A P/B ratio of 2 for SingPK indicates that the stock is trading at a premium to its book value. This could be due to the company's strong growth prospects and potential for future earnings expansion.

Return on Equity (ROE)

The Return on Equity (ROE) measures how effectively a company is using its shareholders' equity to generate profit. SingPK's ROE has been consistently high, indicating that the company is generating significant returns for its shareholders. This is a positive sign for investors looking for companies with strong profitability.

Dividend Yield

The Dividend Yield is the percentage return an investor receives by owning a stock, calculated by dividing the annual dividend per share by the stock's current price. SingPK offers a dividend yield of 3%, which is relatively attractive compared to other companies in the industry.

Case Study: Apple Inc.

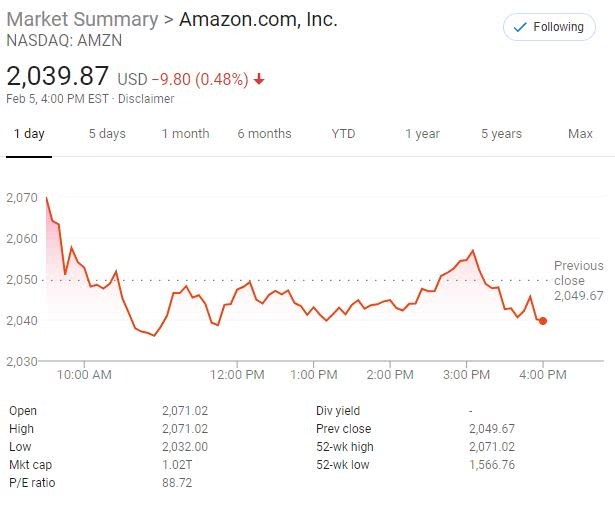

To put SingPK's ratios into perspective, let's compare them with a well-known company like Apple Inc. Apple has a P/E ratio of 30, a P/B ratio of 4, and an ROE of 26%. While SingPK's ratios are slightly lower, it is important to consider the growth prospects and industry dynamics when making investment decisions.

Conclusion

In conclusion, SingPK's stock ratios provide a comprehensive view of its financial health and growth potential. With a strong P/E ratio, EPS growth, and attractive dividend yield, SingPK appears to be a compelling investment opportunity. However, as with any investment, it is crucial to conduct thorough research and consider individual risk tolerance before making any decisions.

us flag stock

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....