In the ever-evolving world of finance, the stock market has proven to be a dynamic and unpredictable entity. Over the past five years, the market has experienced significant fluctuations, showcasing both opportunities and challenges for investors. This article aims to provide a comprehensive analysis of the stock market over the past five years, highlighting key trends, factors influencing the market, and potential future directions.

Market Performance

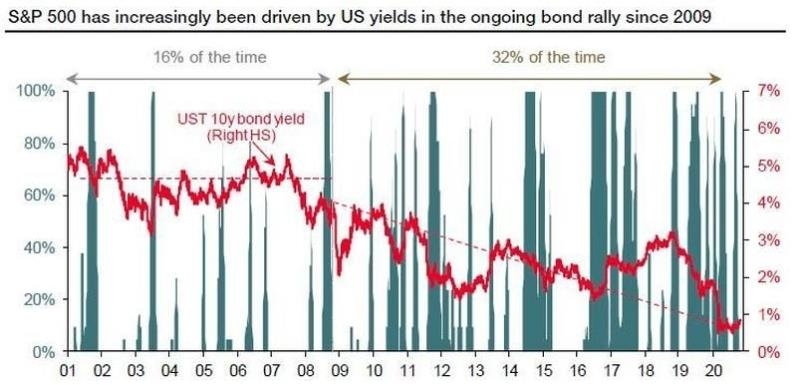

The stock market has experienced remarkable growth over the past five years. According to data from the S&P 500, the index has surged by approximately 30% during this period. This upward trend can be attributed to various factors, including low-interest rates, strong corporate earnings, and a recovering economy.

Trends in the Stock Market

Technology Stocks: The technology sector has been a major driver of the stock market's growth over the past five years. Companies like Apple, Amazon, and Microsoft have seen significant increases in their stock prices, contributing to the overall market performance.

Dividend Stocks: Dividend-paying stocks have also been a popular choice among investors. These stocks provide investors with regular income, making them an attractive option during uncertain economic times.

Sector Rotation: Investors have been actively rotating between sectors, seeking out opportunities in areas with strong growth potential. This has led to volatile movements in the stock market, as investors shift their focus from one sector to another.

Factors Influencing the Stock Market

Economic Factors: The state of the economy plays a crucial role in the stock market's performance. Factors such as GDP growth, inflation rates, and unemployment rates can all impact investor sentiment and market trends.

Political Factors: Political events, such as elections or policy changes, can also have a significant impact on the stock market. Uncertainty in the political landscape can lead to volatility and uncertainty among investors.

Technological Advancements: Technological advancements can disrupt entire industries, leading to significant shifts in the stock market. Companies that embrace innovation and adapt to these changes tend to outperform their competitors.

Case Studies

Facebook's IPO: In 2012, Facebook's initial public offering (IPO) was one of the most highly anticipated events in the stock market. However, the stock experienced a significant drop in its first few days of trading, highlighting the volatility and unpredictability of the market.

Tesla's Growth: Tesla, an electric vehicle manufacturer, has seen a meteoric rise in its stock price over the past five years. This growth can be attributed to the company's innovative products, strong brand presence, and commitment to sustainable energy.

Future Outlook

Looking ahead, the stock market is expected to continue experiencing fluctuations, driven by a variety of factors. Investors should remain vigilant and stay informed about market trends, economic indicators, and political events. Diversifying their portfolios and maintaining a long-term perspective can help mitigate risks and maximize returns.

In conclusion, the stock market has experienced significant growth and volatility over the past five years. By understanding key trends, factors influencing the market, and potential future directions, investors can make informed decisions and navigate the complexities of the stock market.

us flag stock

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....