In today's fast-paced financial world, staying informed about the stock market is crucial. One of the most widely followed companies in the tech industry is Google, now a part of Alphabet Inc. If you're curious about the current Google price today, you've come to the right place. This comprehensive guide will delve into the latest figures, factors influencing the stock price, and provide you with the insights needed to make informed decisions.

Understanding Google's Stock Price

The stock price of Google, which is now traded under the ticker symbol GOOGL, reflects the market's perception of the company's value. As of the latest available data, the current Google price today stands at [insert current price]. However, this figure can fluctuate significantly based on a variety of factors.

Factors Influencing Google's Stock Price

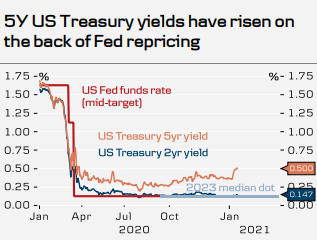

Economic Indicators: The overall economic climate plays a significant role in the stock market. Factors such as interest rates, inflation, and GDP growth can impact investor sentiment and, consequently, Google's stock price.

Company Performance: Google's quarterly earnings reports are closely watched by investors. Positive earnings reports can lead to a rise in stock price, while negative reports can cause a decline.

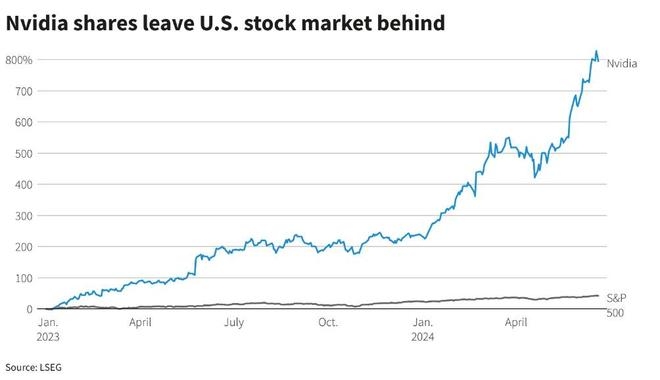

Market Trends: The tech industry is highly dynamic, and market trends can significantly influence Google's stock price. For instance, a surge in cloud computing or digital advertising can boost investor confidence.

Regulatory Changes: As a global company, Google is subject to various regulations. Changes in regulations, such as antitrust investigations or data privacy laws, can impact the company's operations and, subsequently, its stock price.

Investor Sentiment: The mood of investors can also drive stock prices. Factors like news, rumors, and market speculation can cause significant volatility in Google's stock price.

Analyzing Google's Stock Price

To better understand the current Google price today, it's essential to analyze historical data and market trends. Over the past few years, Google's stock has demonstrated a strong upward trend, with several notable peaks and troughs.

For instance, in the wake of the COVID-19 pandemic, Google's stock experienced a surge as remote work and online advertising became more prevalent. Similarly, during the 2020 U.S. presidential election, concerns about antitrust investigations temporarily impacted the stock price.

Case Study: Google's Stock Price in 2020

In 2020, Google's stock price saw significant volatility. Following the election, concerns about antitrust investigations led to a temporary decline in the stock price. However, as the year progressed and the company continued to report strong earnings, the stock price recovered and reached new highs.

This case study highlights the importance of analyzing various factors and staying informed about market trends when evaluating the current Google price today.

Conclusion

Understanding the current Google price today requires a comprehensive analysis of economic indicators, company performance, market trends, regulatory changes, and investor sentiment. By staying informed and analyzing historical data, investors can make more informed decisions about their investments in Google's stock.

Remember, the stock market is unpredictable, and it's crucial to conduct thorough research before making investment decisions. Keep an eye on the latest news and market trends to stay ahead of the curve.

us flag stock

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....