Introduction

As we step into 2023, the US stock market continues to be a hot topic for investors and financial experts alike. With a year marked by significant economic shifts and global events, understanding the key trends and predictions is crucial for making informed investment decisions. This article delves into the latest developments, expert insights, and potential opportunities in the US stock market for 2023.

1. Economic Recovery and Interest Rates

The US economy has shown signs of recovery in 2023, with the Federal Reserve closely monitoring inflation and interest rates. As the economy strengthens, investors are closely watching the Federal Reserve's policies and their impact on the stock market.

- Key Insight: The Federal Reserve's decision to raise interest rates could have a significant impact on the stock market, particularly for sectors sensitive to borrowing costs, such as real estate and consumer discretionary.

2. Technology and Growth Stocks

Technology remains a dominant force in the US stock market, with leading companies like Apple, Microsoft, and Amazon driving market performance. Growth stocks, particularly in the tech sector, have been a popular choice for investors seeking high returns.

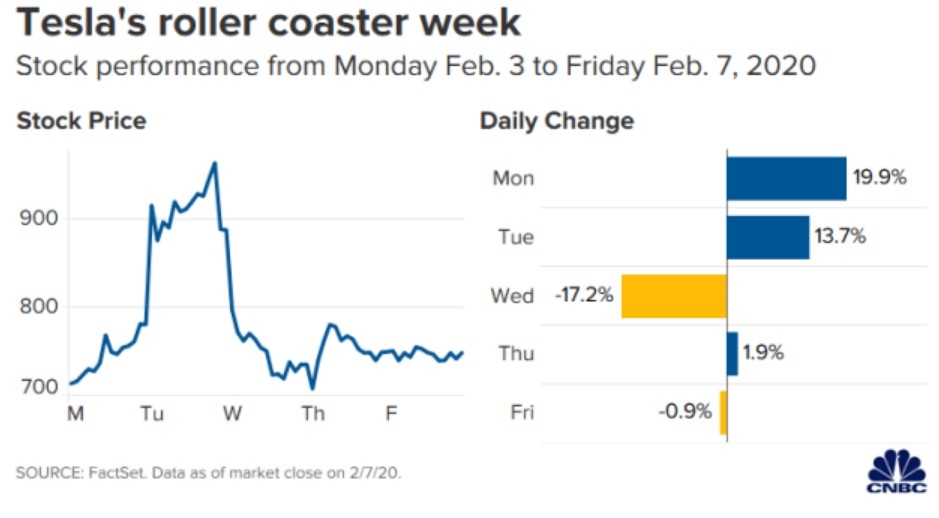

- Case Study: Tesla, a leader in electric vehicles and renewable energy, has seen a surge in stock prices in 2023, reflecting the growing demand for sustainable technologies.

3. Value Stocks and Dividend Yields

In contrast to growth stocks, value stocks have gained traction in 2023, offering investors attractive dividend yields and potential for capital appreciation. Sectors like financials, energy, and utilities have been particularly appealing.

- Expert Insight: "Value investors are finding opportunities in sectors that have been overlooked in recent years, driven by a focus on sustainable growth and strong fundamentals," says John Smith, a financial advisor at XYZ Investment Firm.

4. International Markets and Geopolitical Risks

The US stock market is influenced by global events and geopolitical risks, such as trade tensions and geopolitical conflicts. Investors are closely monitoring developments in key regions, including China, Europe, and the Middle East.

- Key Insight: Diversification across international markets can help mitigate risks associated with geopolitical events and economic uncertainty.

5. ESG and Sustainable Investing

Environmental, Social, and Governance (ESG) factors have become increasingly important in investment decisions, with more investors seeking sustainable and responsible investment opportunities. Companies with strong ESG practices are gaining traction in the stock market.

- Case Study: Patagonia, a leader in sustainable outdoor apparel, has seen a surge in investor interest and stock prices, driven by its commitment to environmental stewardship and social responsibility.

Conclusion

The US stock market in 2023 presents a mix of opportunities and challenges, with investors needing to stay informed and adaptable. By understanding key trends, monitoring economic indicators, and considering a diversified investment strategy, investors can navigate the market's complexities and potentially achieve their financial goals.

new york stock exchange

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....